A practical guide to GMP equalisation – the story so far

There are some key issues relating to guaranteed minimum pensions (GMP) equalisation that trustees should be aware of.

There are some key issues relating to guaranteed minimum pensions (GMP) equalisation that trustees should be aware of. This briefing sets out the practical solutions adopted by the Stephenson Harwood pensions law team to the three most common issues facing our clients as a result of the requirement to equalise GMPs. Member communication in this area is key and, if you need any assistance, please contact your usual member of the Stephenson Harwood pensions law team.

In October 2018, the High Court confirmed in the Lloyds Banking Group judgment that pension scheme benefits had to be amended to counter the effects of unequal GMPs. A supplemental judgment was handed down in December 2018 looking at a specific method for achieving GMP equalisation. For more background please see our briefing on the Lloyds decisions here.

Since the judgments, the industry has been attempting to deal with the practical implications of the requirement to equalise GMPs effectively. Industry groups are working to provide guidance on standard approaches to some of the key issues arising from the judgment. Whilst this area is, therefore, one that will continue to develop, this briefing attempts to offer some guidance based on how things currently stand.

Transfers out

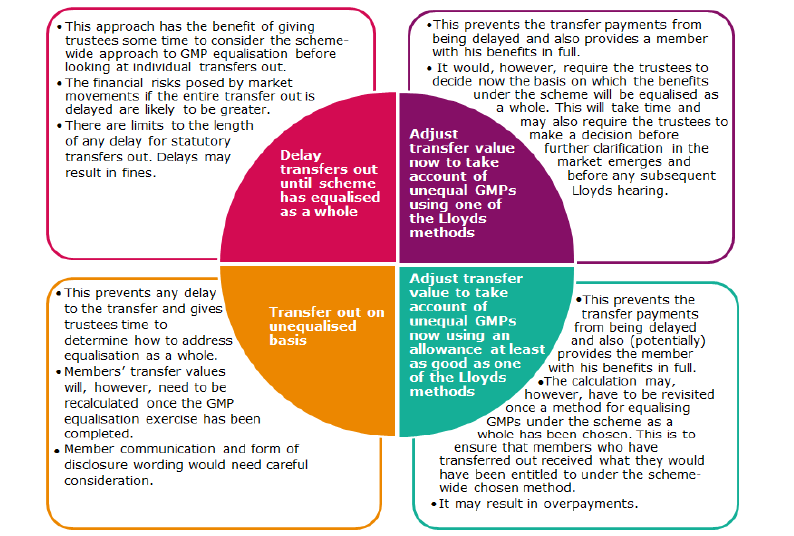

A key question that has arisen since the Lloyds decision is how a request for a transfer out should be dealt with. There are a number of different options available, each of which have their own advantages but also attract their own challenges.

Any option that could result in a subsequent 'top-up' payment being made will also pose the following risks:

- if the initial payment is considered to have been a partial transfer, trustees may not benefit from a statutory discharge;

- a receiving scheme may not be willing to accept a subsequent 'top up' payment;

- there are uncertainties over the tax treatment of any 'top up' payments; and

- the subsequent 'top up' payment may trigger the "advice" requirements if defined benefits then exceed £30,000.

What is clear is that there are no risk free approaches. Nevertheless, dealing with transfer out requests is an immediate issue that requires a practical solution. An industry standard practice may also evolve with the publication of guidance and a potential further hearing in the Lloyds case.

The correct solution will vary from scheme to scheme depending on the specific circumstances. Currently, the most common approach is a 'business as usual' approach, with transfers out being made as usual on an unequalised basis, with an adjustment to follow where necessary.

Trivial commutation lump sums

If trivial commutation payments are made before the GMP equalisation exercise has been completed, one of the issues that may arise is what happens if any subsequent GMP 'top up' payment increases the member's benefits above the £30,000 trivial commutation limit?

In addition, the trivial commutation legislation requires the trivial commutation payment to extinguish certain benefits. This will arguably not be the case if a 'top up' payment is subsequently made.

The sums involved with trivial commutation are likely to be smaller than those involved with transfer requests. The out of market risk may not, therefore, be as significant. In addition, in our experience, trivial commutation is often discretionary. For these reasons (and with the possible unintended tax consequences that may result from the payment of the lump sum with a subsequent 'top-up' to follow) a practical answer to the problem, for now, may be to suspend trivial commutation lump sum payments until the scheme as a whole has dealt with GMP equalisation.

Serious ill-health lump sums

As with trivial commutation lump sums, the payment of a serious ill-health lump sum must extinguish a member's benefits. Again, questions arise as to whether this can happen if a payment is made before GMP equalisation has been completed. In contrast to a trivial commutation lump sum exercise, however, time is of the essence in this scenario. It is likely to be inappropriate to suspend the payment of these sums.

Given the time urgency involved in these cases, a practical approach is to grant the payment of the serious ill- health lump sum. The Stephenson Harwood pensions law team can assist with drafting member communications to try and minimise any adverse tax consequences and to provide trustee protection for any liability that may arise.